Our streamlined account setup process ensures you can start trading quickly and hassle-free. No more waiting for days to get started; we prioritize your time and convenience

We're committed to providing you with the most competitive trading costs in the industry. Our low fees mean more of your hard-earned money stays in your pocket.

Join our vibrant trading community for free. Exchange insights, strategies, and market knowledge with fellow traders to enhance your skills and stay informed.

We partner with top-tier liquidity providers to ensure you have access to the best market rates and minimal slippage, giving you the upper hand in your trades.

Your peace of mind is our priority. Our dedicated support team is available around the clock, ready to assist you with any questions or issues you may encounter while trading.

We take security seriously. Our platform is built with robust security measures, and we are fully regulated to provide you with a safe and trustworthy trading environment.

Unlock endless investment potential with our versatile trading asset widget!

Whether you're into stocks, cryptocurrencies, or commodities, this widget empowers you to invest in your favorite assets with ease. Seamlessly monitor, trade, and diversify your portfolio all in one place. Don't just watch the markets; be a part of them!

Get access to a wide variety of instruments and assets.

Trade the largest and most liquid market in the world with the preferred platform for forex trading.

Diversify your exposure with global indices like the S&P 500 and the Nikkei 225.

CFD Trading in both hard and soft commodities including crude oil, copper, sugar and silver.

Find opportunities with leveraged trading in shares of the world’s biggest companies like Tesla and Amazon.

Trade bullion without having to take delivery of the underlying asset. Spot gold trading at leverage.

Trade the most popular ETF instruments with leverage.

Discover different types of accounts tailored to suit your trading needs on every level possible.

Start trading now and experience the difference on the go! If special setup is needed don’t hesitate to reach us!

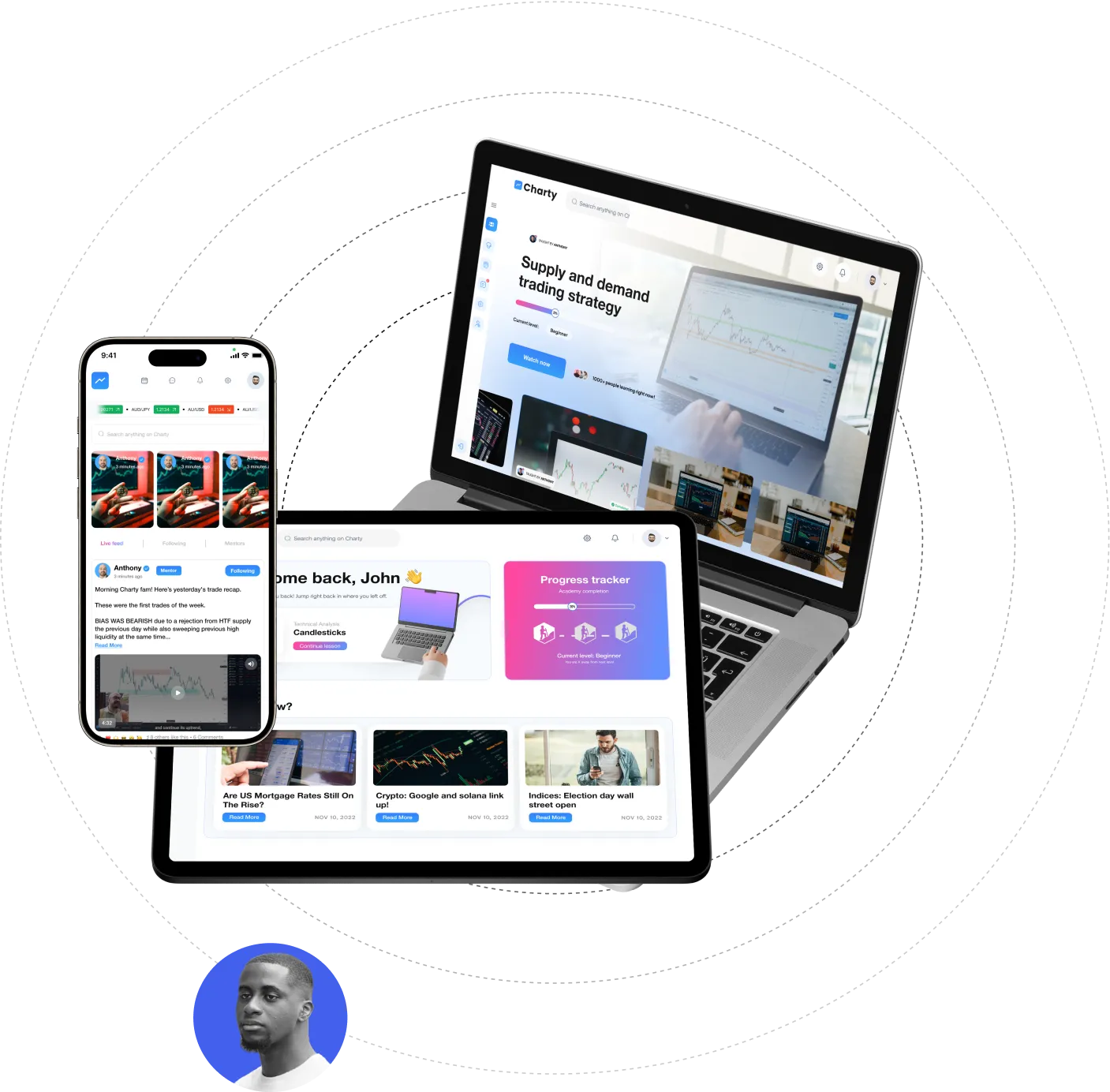

Make the best trading decisions and learn more about the market on a daily basis with our Community. Deep dive into a wide range of opportunities, share your knowledge with others, and stay updated about what is going on with the market. Never miss a thing!

Learn More

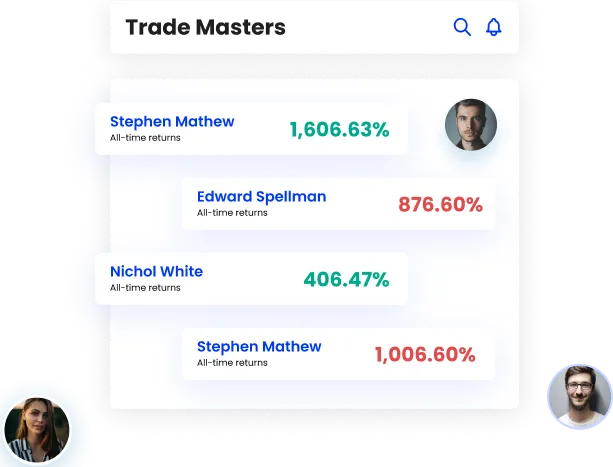

Explore the world of copy trading at The Raptor Market.Our platform offers an exceptional copy trading service, allowing you to follow the strategies of seasoned traders. Harness their expertise, replicate their success, and navigate the financial markets with confidence. Join us and embark on a trading voyage like no other.

Learn More

Experience trading like never before with our cutting-edge, AI-driven platform that adapts to market trends and provides you with unmatched insights and opportunities. Join us to lead the way in innovative trading.

Count on our platform's rock-solid stability and lightning-fast execution to ensure your trades are executed with precision, even during the most demanding market conditions.

Learn More

Dive into a realm where stocks and forex currencies are your compass points. With an extensive range of assets at your fingertips, you can seize opportunities in both established and emerging markets.

Whether you're a seasoned trader or just starting, there's a wave of potential for every level of expertise.

Open an account and get verified in less than 60 seconds. Join our community and start trading today

Submit your personal

details to create a live account with in seconds

Fund your trading account by using any of the available payment methods

Start trading in less than couple of minutes and enjoy the market waves

We invest heavily in trading technology and tools that surpass industry standards. Our platform's speed, reliability, and user-friendly interface ensure traders have a seamless and efficient experience.

Our dedicated team is available 24/7 to address your queries and concerns promptly. Feel free to reach out to us on different channels: Live Chat, Calls, Emails and WhatsApp.

We operate with utmost transparency and adhere to strict regulatory standards to ensure your funds and data are secure. Our commitment to ethical trading practices and regulatory compliance sets us apart from others.

The more you friend you invite the more you get endless sea of opportunities Experience the full potential of referrals.

Start now

Best Execution - We’ll maintain our commitment to act honestly, fairly and in the best interests of all our clients to offer the best possible execution.

Segregated Account - Your funds will be kept in a segregated account at all times under the FSA’s Client Money rules.

Balance Protection - We will continue to protect your account from a negative account balance.